Sage Pastel VAT 201

Automating your VAT submissions with Sage AccountingSee more

Module 1: VAT201, Compliance, Risk and ReportingSee more

Completion of VAT Return (VAT201)See more

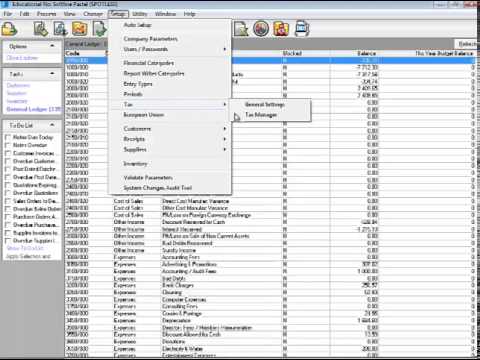

VALUE ADDED TAX (VAT) SETUP ON SAGE PASTEL PARTNERSee more

Pastel Accounting softwareSee more

VAT Guide for Beginners on Sage in 10 Easy StepsSee more

VAT returns and reconciliations with MyVAT from Pastel Xpress, Pastel Partner or Sage 50CloudSee more

Processing Opening Balances and Viewing Trial Balance on Sage Pastel AccountingSee more

Processing ReceiptsSee more

Recording Payments and Receipts on Sage Pastel Accounting(COMPREHENSIVE FOLLOW ALONG TUTORIAL)See more

Sage for Accountants (UK) - VAT OverviewSee more

Automate VAT reconciliations by transaction in Pastel Partner, Pastel Xpress & Sage 50CloudSee more

Sage - Preparing a VAT returnSee more

How to File an EMP201 Tax ReturnSee more