Value Added tax VAT August 2023 Question 2c

VALUE ADDED TAX - DEDUCTIBLE INPUT VATSee more

Value Added Tax – VAT (part 2) - ACCA Taxation (FA 2022) TX-UK lecturesSee more

Chapter 24 Value Added Tax – VAT (part 2) - ACCA TX-UK Taxation (FA 2023)See more

Chapter 24 Value Added Tax – VAT (part 3) - ACCA TX-UK Taxation (FA 2023)See more

VAT CPA December 2022 Question 2(b)See more

VAT CPA SEC 2 Dec 2021 2c Value Added TaxSee more

Chapter 24 Value Added Tax – VAT (part 1) - ACCA TX-UK Taxation (FA 2023)See more

Value Added Tax – VAT (part 1) - ACCA Taxation (FA 2022) TX-UK lecturesSee more

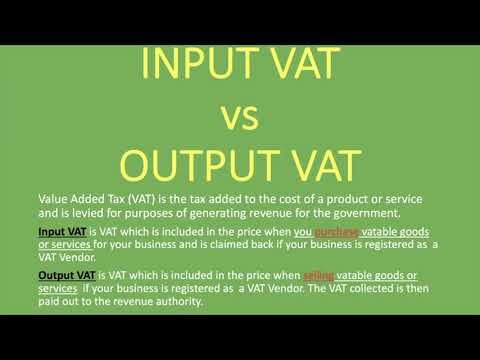

Input VAT vs Output VAT | ExplainedSee more

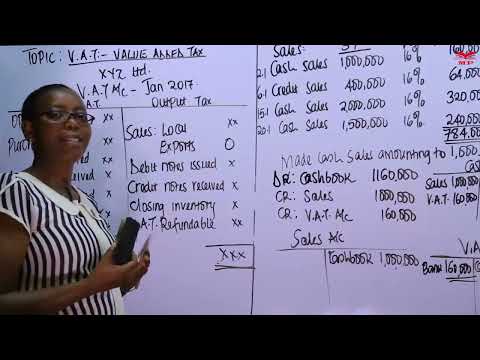

V.A.T PayableSee more

Value Added Tax Lesson 2 - VAT CategoriesSee more

Value Added Tax (VAT) at 50: what does the future hold?See more

Value Added Tax in English for TX (VAT) - ACCA {March 2024 Attempt}See more

PFT :AUGUST 2023 QUESTION 2CSee more

Value added tax (VAT)See more

VAT (Value Added Tax) In Kenya - All you need to know | Joe GachiraSee more